Shopify is truly a great product. They allow ‘wantra’-prenurs to become entrepreneurs. They allow small businesses to flourish.

One of the most challenging aspects of Shopify is the accounting piece. Let’s dive into this a bit deeper.

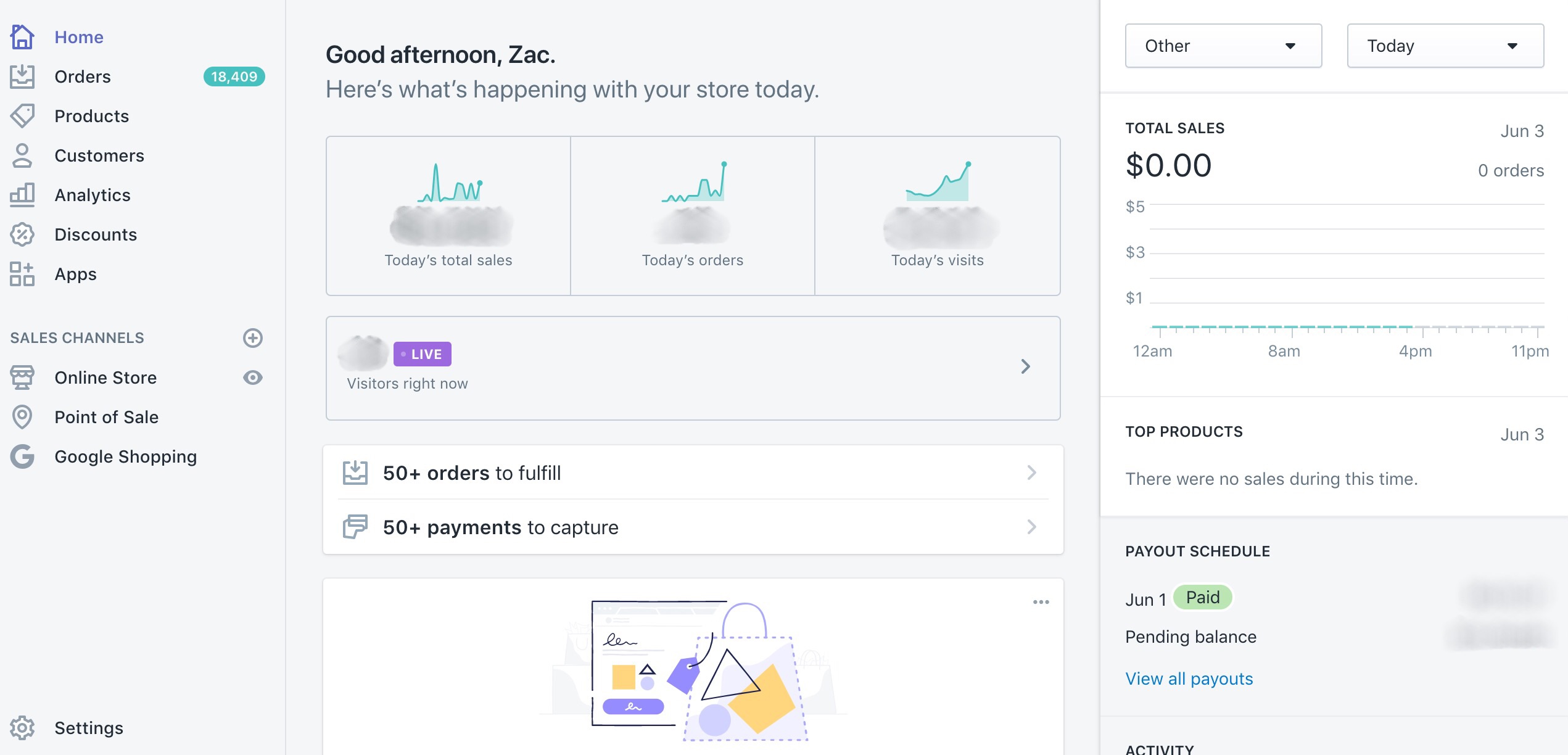

Let’s take a look at a simple Shopify setup. You launch your store. You list your products. Link to your bank account. Hustle to get customers and boom! you get some sales. Now a few days later, you get a deposit in your bank account.

Get Started Recording Shopify Sales

That deposit is really not all the money you received for the sale. Really you received a few percentage points more. To find out what exactly is going on, let’s take a look at the payouts within Shopify.

This can be found on your homepage under ‘view payouts’ on the right half of the screen. Now, select the most recent date that matches the amount seen on your bank account.

This will allow you to see the full picture. Shopify keeps some of the money for processing and often times you will see your refunds deducted from a future payout.

The key to accounting properly is tracking all those additional expenses and refunds. What good are financial statements if they do not record everything going on in your business?

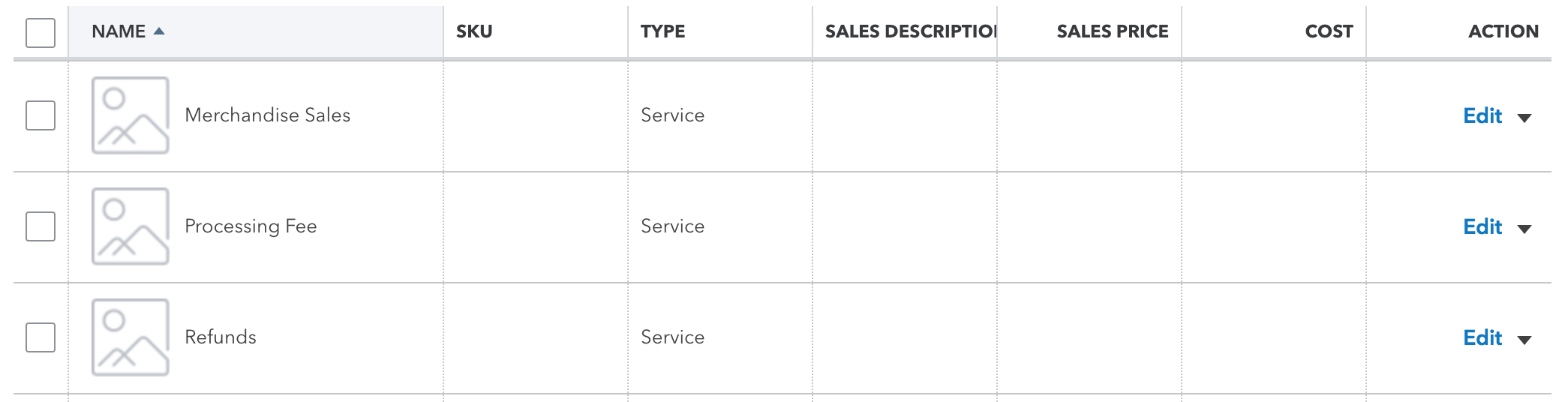

Let’s take a look at how we can track all the aspects of the transaction. For those using QuickBooks, you would go to ‘item list’ and create three different services:

- Merchandise Sales

- Processing Fees

- Refunds.

Sale of products should map to the income item in your chart of accounts, where you record revenue.

Merchant processing should map to credit card fees on your chart of accounts (usually under bank fees).

Refunds should hit a line item under income titled refunds, usually an income item.

Let’s take a look at how these are mapped. Please be aware the exact chart of accounts will vary business to business based on your configuration.

Merchandise Sales

Processing Fees

Refunds

Once done, you have the basic framework for success and need to record your sales.

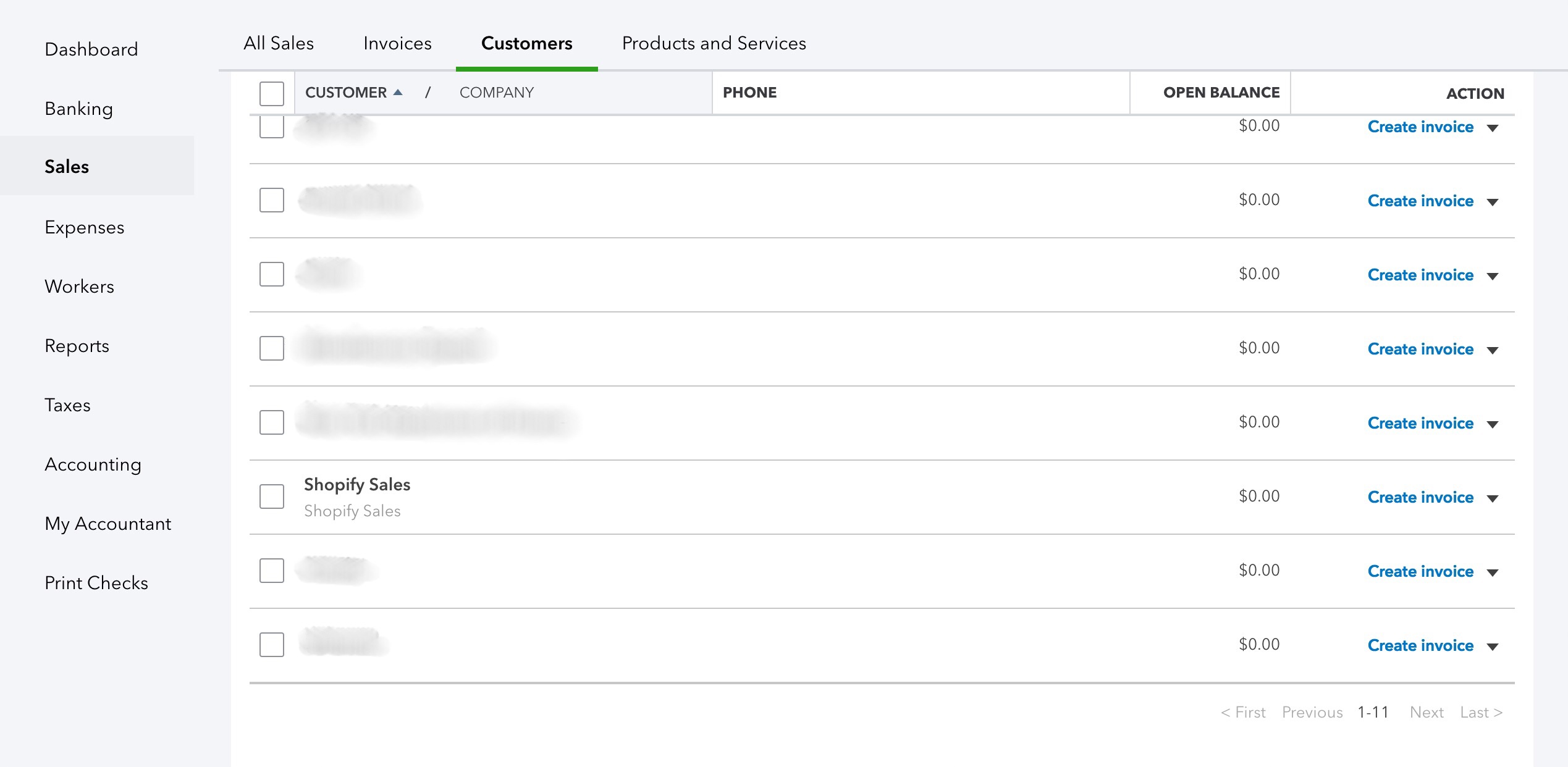

Creating the Customer Called Shopify Sales

We then want to create a “new customer” where we will track all our Shopify sales. This customer will simply be called Shopify Sales. Under this customer we want to create a sales receipt.

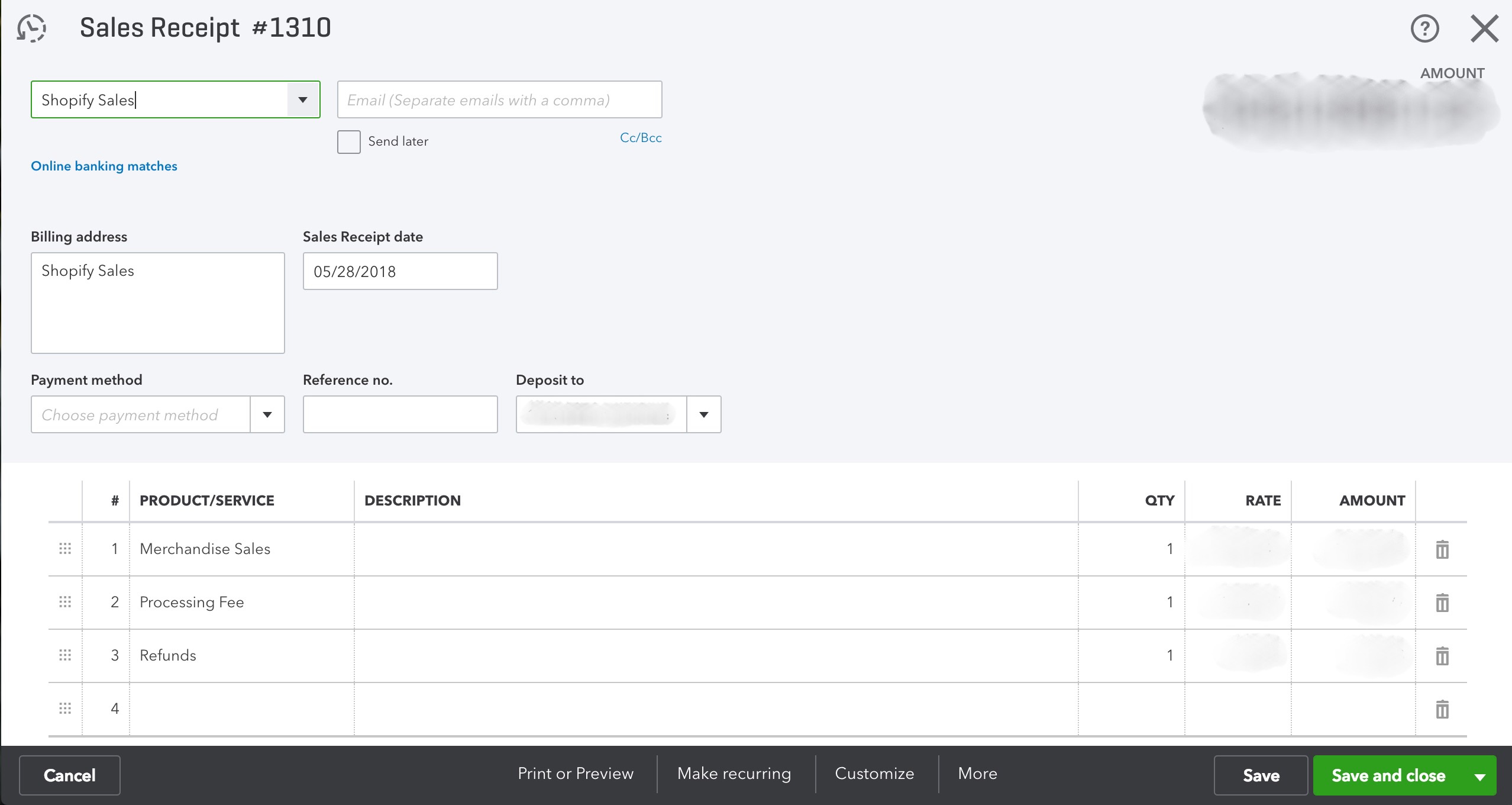

Let’s pull up a recent deposit in Shopify. You will see the three components we added to the item list. Those items are the total sales, credit card fees, and refunds.

Create a Sales Receipt Inside Quickbooks

On the sales receipt, the total sales should be positive, the credit card should be negative (subtracted from total sales) and the refund should be negative (subtracted from total sales).

The date should be the date in which the majority of the sales took place. Save this sales receipt.

Now, pull the income statement under reports. The sales, refunds, and credit card expenses should now appear on your income statement. If you did this correctly they will map to the correct accounts on this report.

Successfully Recording Shopify Sales in Quickbooks

You have now properly recorded Shopify sales in QuickBooks! This method can also be used for all other accounting software as well.

It is important to note that this method does not track the cost of goods (aka COGS). COGS will need to be tracked in a separate method. So the above works great for a solo-preneur who uses the cash basis method of accounting.

The other way to quickly track COGS is to generate one invoice at the month end for all items sold during the period – by using a $0 sales amount for that invoice, you will easily track the COGS knowing your revenue is correct as outlined in the method above.

Learn About Flowify

Having trouble integrating all your sales, refunds, fees, bank deposits (& more) seamlessly from Shopify into QuickBooks? Flowify is a sleek Shopify accounting app that I recommend. It is the secret sauce that helps propel Shopify stores to next-level success. Learn more by clicking here.

How would this work in the QB desktop ?

The process would work exactly the same. From generating the items in the item list to creating the sales receipts (Desktop just has a different user interface).

I actually developed an app that automates this entire process for a monthly fee. Flowify automates recording of sales, refunds and fees for Shopify – working while you sleep 🙂

Hello, great article. In the Sales Receipt form you don’t have the payment method entered. Would this be cash? Also you have the Deposited to field blocked out, would this be Deposited Funds or the checking account where the money was deposited into?

Thanks

Glad you found this helpful. QBO does not require a payment method, you could use a credit card, or set up Shopify Payments if you like. I prefer to deposit the sales receipt directly into the operating bank account (where the Shopify money is deposited).

I also built an app that does all this for you automatically: https://flowifyaccounting.com/

Hi,

I have a question.

As you suggested, i have put the processing fee as credit card fees.

But when I enter this on the sales receipt, it adds the fee to the total of the sales receipt. It looks like income. so i assume when QBO searches the bank records to match it – it’s looking for a higher number (sales + processing fees)

Should be be entering the processing fees as a negative figure (e.g -23.34)?

Sam

Hi,

Sorry, another question.

What about sales where the customer pays via paypal?

These won’t show up on the shopify payouts

Sam

Hi Sam,

You should book all the PayPal sales in one monthly journal entry. Similar methodology to this post but too detailed for me to cover in a comment. Perhaps I will make another post on this at a later date.

Zac

Hi Sam,

That is correct; as referenced in the post ‘On the sales receipt, the total sales should be positive, the credit card should be negative (subtracted from total sales) and the refund should be negative (subtracted from total sales).’

Zac

Hi Zach – thank you for this process! Question – I have chosen to have a sales receipt created by Shopify for each customer – and then automatically sent to QB. Does the same process apply? Can I just go into each Sales Reciept in QB and add in the fee and the refund if applicable? And the SR is recorded directly against my bank account in my Chart of Accounts? Thank you!

Hi Lisa,

Yes, you could edit the sales receipt to include those items. It will be a bit tedious though, especially if Shopify is creating a sales receipt for each customer transaction. You could also clear multiple sales receipts together (by configuring sales receipts to go into undeposited funds), adding the fees expenses in the deposit center, as will likely be necessary to match your deposit.

Thanks,

Zac

Hi Zach – one more question on this – are the processing fees a ‘taxable’ service? And what about the Refund service?

Thank you!

Hi Lisa,

This depends on your configuration. Usually, processing fees are not taxable. Refunds may be, if your original sale was, so it could vary depending on multiple factors. I recommend tracking sales tax with one monthly journal entry, versus trying to track it through the QBO sales tax feature, I find it easier that way.

Zac